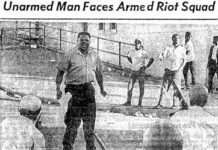

Editorial by Willie Ratcliff

On June 15, the U.S. Small Business Administration, revitalized by President Obama, launched the ARC program, America’s Recovery Capital, giving banks and credit unions 100 percent guarantees so they’re taking no risk when they make loans of up to $35,000 to small businesses. The borrower pays no interest and makes no payments for 12 months, then has five years to repay the loan. SBA charges no fees and pays interest to the lender at prime plus 2 percent. So don’t let your lender say no; it has no excuse for denying one of these Unsecured loans all you need to know to a viable, established business.

As Willie Brown, publisher of Inglewood Today, writes in an editorial headlined “‘Buy Black’ Boosts Economic Survival”: “Until the mid-‘60s, African Americans bought from each other and built their own schools, libraries and hospitals out of necessity. While racist laws of the day kept many from receiving full social status (i.e., living wherever they wanted), they were able to live well because the money flowed back into their neighborhoods. Black Wall Street, a business district in Tulsa, Okla., boasted a thriving Black economy during the oil boom in the 1920s.” In the Bay Area, we have to look no further for historic inspiration than Fillmore Street in San Francisco, Seventh Street in West Oakland and East 14th in East Oakland.

Once you’ve read up on the ARC program, you may have to educate your local lender. The loan manager at the Wells Fargo branch on Third Street in San Francisco’s Black heartland hadn’t heard a word about it when I asked on June 16, the day after the program launched. He called later to assure me that Wells Fargo will be making ARC loans.

If putting a Black president in the White House hasn’t magically brought peace and prosperity to every hood in the land, now his Small Business Administration is giving us a leg up on the ladder to Black self-sufficiency, a prerequisite to a healthy community. To tap into the wisdom of some visionaries committed to building the Black economy, visit Jim Clingman at Blackonomics.com, the Anderson family at ebonyexperiment.com and the late Muhammad Nassardeen of Recycling Black Dollars at RBDmedia.net. If you’re ready to think big, go to BlackEnterprise.com. And to organize with other Black entrepreneurs to demand our fair economic share, check out the National Black Chamber of Commerce at NationalBCC.com, headed by Black business champion Harry Alford.

Bay View publisher Willie Ratcliff can be reached at (415) 671-0789 or publisher@sfbayviewnews.wpenginepowered.com.

Store

Store