by Carol Harvey

Editor’s note: Please sign the petition to save Archbishop King’s home: John G. Stumpf: SAVE ARCHBISHOP FRANZO KING’s HOME IN SF BAYVIEW.

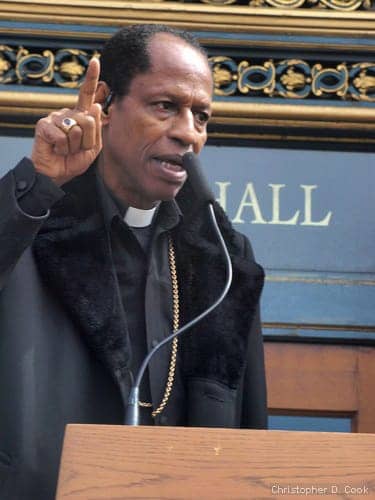

I first met Archbishop Franzo Wayne King and felt his warm wit and humor on a sunny Saturday, Feb. 25, 2012, at the top of Russian Hill. Occupy Bernal performed a street theater auction of bankster Wells Fargo CEO John Stumpf’s top floor condo at 1090 Chestnut overlooking Alcatraz in San Francisco Bay.

The 150-strong rabble’s fanciful bids for Stumpf’s foreclosed condo included a tree stump, five corrupt judges, Jean Quan, Ed Lee and The American Dream. Peppered among these bids, the archbishop tossed “a bag of peanuts,” “one pigfoot,” “a jail cell,” “one American nightmare” and “a one-way ticket to hell.” His final offering was “five security guards” – a nod to the burly dudes standing five-strong across the highrise entrance.

A tiny head poked from a top floor window. This Stumpf servant or granny peered far below upon the archbishop as he told the gathered riffraff:

“I’m Franzo King. I’m the archbishop of the St. John Will-I-Am Coltrane African Orthodox Church. Mr. Stumpf, your Stumpfing is over. No more Stumpfing on the poor. You have used machines to falsify court documents through robosigning rather than properly serving legally required notices to tenants and homeowners.”

Robosigning was just one crosshair in a meshwork of crimes pulled off by Wells Fargo and the other big banks.

Imagine Stumpf two months before semi-confessing his heist sitting down the hall from his indentured looky-loo in his ornate living room high above the riffraff. Around Nov. 18, 2011, DiversityInc’s CEO, Luke Visconti, apparently shot a YouTube video entitled “DiversityInc Interview With John Stumpf, Wells Fargo.”

http://youtu.be/NHvC5Usc_YA

“We’re all aware of the sub-prime crisis,” begins Visconti. “Wells Fargo was recently fined $85 million for practices related to subprime lending. Given the subprime crisis disproportionately affecting Black, Latino and/or women heads of household, why was Wells Fargo fined? How is Wells Fargo working to improve financial literacy in the Black and Latino communities?”

“It’s a fair question.” John Stumpf, freshly shaved, stuffed pinkly into his white shirt, appears tense as if he has eaten a plateful of rotten eggs. Describing his own “humble” beginnings, Stumpf explores Well’s Fargo’s “deep commitment to diversity.”

Despite Stumpf’s 2011 insistence on his diversity sensitivity, by March 28, 2012, three months later, he managed to throw at least five of his African American neighbors from their homes of 40 years, Dexter Cato and his four children from the Bayview and from Noe Valley, Kathryn Galves and her elderly sister. Cato had just lost his wife. Galves suffers high blood pressure multi-organ damage. Stress could kill her.

The local, national and world community knows, loves and respects Archbishop King’s work using sound to bring people to “the preexisting wisdom of God.” During my visit to St. John Coltrane Church at 1286 Fillmore on March 25, 2012, travelers from England and Washington state joined in prayer set to Coltrane’s African American classical music performed by the archbishop on saxophone and dedicated to spreading Coltrane consciousness.

After experiencing a live 1965 Coltrane performance, Archbishop and Rev. Mother Marina King began their mission in 1971. Hearing John William Coltrane’s music that night recreated the archbishop’s familiar childhood awareness of God’s presence. “We knew Coltrane’s music was an anointed sound that leapt down from the throne of Heaven out of the very mind of God and incarnated in one John Will-I-Am Coltrane. We beheld his beauty as the anointed of God.”

The name John means “the gift of God,” the Archbishop told me. God told Moses He was “I-Am.” “The I-Am [in Coltrane’s middle name, William] talks about the presence of God with the people. So instead of saying William, we say, ‘the Will of God manifested in the person of John Will-I-Am Coltrane.’”

Grace Martinez of ACCE, Alliance of Californians for Community Empowerment, has worked closely with the archbishop and other foreclosure fighters, who meet regularly at Vivian Richardson’s Bayview home. “If anything, the fight around foreclosures instills a sense of community and brings people together,” she said. “What other scenario would they be together in to feel that sense of camaraderie?

“The fight around foreclosures instills a sense of community and brings people together,” says Grace Martinez of ACCE.

“People love Archbishop [King]. He’s so fond of Vivian and Josephine. During the Christmas break, they chose not to meet. Archbishop sees Vivian at Walgreen’s, stops and goes, ‘I’ve missed you!’ And it’s like, it’s only been 10 days! People who live from block to block who have maybe engaged superficially, or not really, have built this sense of community around a common goal.”

For roughly 15 years, from the 1980s through the late 1990s, as late as 2007 – World Savings, Countrywide, many mortgage companies and banks inflated the housing bubble by selling toxic mortgage loans. Now this huge pool of mortgages is coming due, culminating in today’s foreclosure crisis.

“Whether or not the homeowner needed a loan, these financial institutions sold loans like a product ‘package.’ Many, like Archbishop King, who kept their mortgage payments current, were sold pick-a-payment loans through San Francisco’s World Savings Bank” – bought out by Wachovia, bought out by Wells Fargo, stated Grace, “like a shark eating a shark eating a shark.”

In 2005, a real estate agent in the African American community whom Archbishop King knew and believed to be reputable approached him saying, “People of color don’t really know how to invest.”

Grace reports the agent suggested to Archbishop King that if he took out the risky pick-a-pay option ARM (Adjustable Rate Mortgage) loan, “it will reduce your payments, fix your credit and you are essentially living on a gold mine because you have so much equity in your house. And this house is worth more than what you paid for it.”

Pick-a-pay loan payments begin small at only 1 or 2 percent. But the bank defers the interest, which varies on adjustable rate mortgages, to the back of the loan. It adds the rest of the interest to the principle at 5 to 9 percent. “Disgustingly,” said Grace Martinez, “I’ve seen interest rates go up to 18.9 percent.”

The agent would provide two, three or four options for your payment method with little explanation, or you were guaranteed you could refinance in a couple of years.

“These loans were presented to a lot of people in the community to refinance or to purchase the property,” stated Grace. The agenda of Wells Fargo and other big predator banks “was very premeditated,” she said, intentionally flooding communities with these loan products.

Wells Fargo has a long history of subprime lending. Grace explains that “in many reports by different groups, there is evidence that [Wells Fargo was] offering higher interest subprime loans to people of color. Those percentages by city were a lot higher than someone who was white and had the same income and credit score.”

A California Reinvestment Coalition report, stated Grace, presented evidence these banks went directly to churches and pastors in communities of color who did not understand these loan products. Banks gave donations to the churches if pastors pushed the products.

The archbishop’s case represents the bank’s underhanded method of flooding communities of color throughout the United States. The manipulative, low-information way banks sold subprimes exposed their predatory nature.

Two years passed. Archbishop King tried to refinance the loan. The brokerage firm had moved; the agent had disappeared. “With all of the fraud in the laws, I thought, like, ‘Wow! He did me.’”

The archbishop’s case represents the bank’s underhanded method of flooding communities of color throughout the United States. The manipulative, low-information way banks sold subprimes exposed their predatory nature.

He went to the San Francisco Housing Development Corp. HUD-certified counselor Ed Donaldson sent him to Kamala Harris’ new Fraud Division.

“There was never any intention to refinance. The good will of [the loan] was the question.”

At the DA’s office, he found a hand-generated document on which his signature had been forged. Someone had written “Franco” instead of his actual name, which is “Franzo.”

Grace Martinez believes the loan’s fraudulence was the agent’s lack of clarification of the loan’s nature and false promises about its potential. They looked to a man who didn’t need a loan, sold that loan on what the money could do, and walked away knowing the payments would skyrocket in two years.

Banks and mortgage companies phoned and knocked on the doors of Bayview residents day and night and sent masses of mail soliciting these loans.

Eventually, the DA dropped Archbishop King’s case. Grace’s assessment: too hard to prove fraud.

In 2007, the archbishop’s debt ballooned. He used loan money to pay off the loan.

“The kind of loan I had [monthly payments] went from $1,200 to $1,600 to $2,800.”

“I saw the future coming.” His stated income had “a shelf life.” His ill mother contributed to the household until she passed on Martin Luther King’s birthday 2011. Wells Fargo refused their modification request.

For two years, they depleted their “little savings,” now gone.

Says Grace, “You pay until you can pay no more. Many homeowners face losing electricity and food.”

In 2009, at NACA’s [Neighborhood Assistance Corporation of America] Cow Palace foreclosure event where thousands slept over, the Kings couldn’t get a modification because they were current. “You don’t qualify until you’re at least two months behind.

“I’m looking up, and I’m another $30,000 to $40,000 dollars in arrears, only paying the interest.

In late 2008 or early 2009, he first approached Wells Fargo for the modification he never received.

Last year, 2011, they fell behind.

When the crisis hit banks, foreclosure departments hired huge staffs to manage the explosion. This created a level of incompetence gumming the works today.

States Grace, “You request a loan modification. If they respond and you are still current, they say you need to fall behind or “We didn’t get all the paperwork” or “Send the paperwork again.” This drags on for months.

She thinks it’s a combination of lying and incompetence – lack of a system to deal with the number of foreclosure cases and high turnover of staff within the bank.

Wells Fargo’s modification and foreclosure departments live in different cities or states. While the homeowner applies for mortgage modification, the lender pursues foreclosure. In this dual tracking system, the right hand knows not what the left is doing.

While the homeowner applies for mortgage modification, the lender pursues foreclosure.

On Archbishop King’s behalf, Occupy Bernal approached Supervisor David Campos, who sat down with Wells Fargo. The bank postponed the archbishop’s original sale date, Dec. 13, 2011. His case has apparently escalated to the CEO’s and vice president’s offices. They have barely responded.

He calls Wells Fargo each week. Yesterday he actually talked to someone. The bank employee repeated, “We still have a sale date next week. It’s still under consideration.”

“Last year John Stumpf made $19.6 million,” says Grace. “The Los Angeles Times wrote he’s just a farm boy who worked his way up the ranks.”

On March 18, 2012, L.A. Times’ Nathaniel Popper quoted Stumpf reprising the Visconti video: “We grew up on this 120-acre dairy and poultry farm. I’ve said many times, we were poor in some of the world values, but we were rich in some of the values that really are important, like personal responsibility, teamwork, respect for each other, helping out.”

Grace observes, “In 2010, these CEOs collectively made $160 billion in bonuses. Enough to pull everyone in California out of foreclosure times four. They profit off the suffering of others.

“Their lack of compassion or desire to work with people makes me think they’re sociopaths unable to see beyond their personal financial growth.”

Says Archbishop King: “I’m more concerned about my neighbor or his grandmother who labored in the shipyard to get these houses – living clean, doing right and being honest, hardworking people on the principles they brought from the South. Now some sucker is going to come up and hit them in the back of the head and leave them in the graveyard for dead.”

But, states the archbishop firmly, “These perpetrators, these bank guys, they didn’t just come after individuals; they came after Black institutions as well.

Says Archbishop King: “I’m more concerned about my neighbor or his grandmother who labored in the shipyard to get these houses – living clean, doing right and being honest, hardworking people on the principles they brought from the South. Now some sucker is going to come up and hit them in the back of the head and leave them in the graveyard for dead.”

“I think the Lord pulled me in it so I could speak for people who can’t speak for themselves.

“I love to beat the drums way early in the morning, about 3 or 4 o’clock. I don’t want the ‘master’ sleeping. I want him to know that the people in the village are upset. I don’t want him to rest. If this is an opportunity to keep the slave drivers from resting at night, then I’m glad to be about that.”

As I was finishing this article, Archbishop King reported that a person from Wells Fargo’s executive office named Jamie, claiming to be “an executive member of Wells Fargo Bank” told him his sale date was moved to Monday, May 7, 2012.

“I asked her, ‘How did that happen?’ She said, ‘Just talking.’ I don’t know what that means – me talking or her talking or whatever.

“She said she really wanted me to have a good weekend and a good Easter. She told me that in a week, I should hear something about my application.”

And have you?

“No. But they said that last time.”

Wells Fargo has failed to give the archbishop documented proof they own his house. He wants the bank “to show me the wet ink – that they, in fact, do own the property. That I, in fact, owe somebody something.” Until they do, “I don’t feel like I owe any money to them.”

Through the San Francisco Interfaith Alliance with Occupy, he found C.J. Holmes, housing policy analyst for Homeowners for Justice.

At Assessor-Recorder Phil Ting’s office together, C.J. checked the paperwork for his September foreclosure. “These people did not even have the authority to proclaim default of foreclosure for you,” she exclaimed. “They don’t get the deed of security until October.’”

Through his own research, Archbishop King found irregularities with his case. On the front end, there is the agent’s forgery. On the back end, the owner of his deed of security is in question.

Phil Ting’s Aequitas Compliance Solutions report shows many people, “This information is missing. We don’t have it, and we need it.”

“Banks need to show proof of ownership of these loans and their legal right for foreclosure. If they are not able to do that, then they can’t foreclose,” he stated.

Additionally, “I think that there are thousands of others that need principle reduction, not just a modification,” from the banks.

Therefore, his focus is on a foreclosure moratorium by the San Francisco Board of Supervisors, along with state Attorney General Kamala Harris’ foreclosure legislation. He’s not satisfied with the state’s attorney’s paltry fine levied on banks for their fraud and theft.

“I’m concerned that there are thousands of people who were illegally foreclosed and evicted from their homes by a bank that had no authority or right to do that. I’m not comfortable with giving somebody $2,000 after you’ve wrecked their dream.”

Because the archbishop is in negotiations with Wells Fargo, his situation is being updated constantly. His perseverance is having an effect. On April 19, he received notification that his sale date has been extended yet again – this time to Thursday, June 21, 2012.

He feels homeowners need to know that individuals and whole communities working together have power to bring movement within banks. People should never give up, but take bold initiative to save their homes.

“A dare to fight is a dare to win!” he declares. “All praise be to God to whom all praise is due.”

Carol Harvey is a San Francisco political journalist specializing in human rights and civil rights. She can be reached at carolharveysf@yahoo.com.