by Lin Robertson

Some minority-owned small businesses took the time to apply for the Economic Injury Disaster Loan (EIDL) by the initial March 31, 2020, deadline and again thereafter. The EIDL disaster loan program was intended to provide working capital to small businesses – apparently not exclusively – with funding of up to $2 million, including an immediate $10,000 advance within a few days after applications were submitted to the Small Business Administration (SBA).

To be eligible for EIDL assistance, small businesses were required to show sustained economic injury and be located in a disaster declared county. You would therefore think that small businesses like those located on Third Street in Bayview Hunters Point would actually be ideal loan applicants, right? Not so fast.

To qualify, EIDL loan applicants had to first pass a credit check. And while the SBA gave few guidelines on what credit scores would be deemed as “acceptable to SBA,” small businesses could be turned down if they did not have good business credit. The SBA also considered other factors like your track record with on-time rent, utilities, insurance and other bill payments.

In other words, if you were a struggling business already, you were less likely to get EIDL help to survive the COVID-19 pandemic crisis.

Small minority-owned businesses all over the country recently received denial letters with the notification that they have an “unsatisfactory credit history.” Many never received the $10,000 advance which was supposed to serve as a grant even if you were denied the loan. Neither did they receive the lesser $1,000 per employee for micro businesses or the self-employed in lieu of the $10,000 loan advance. And good luck with getting a reversal to being declined the EIDL loan six months later.

Some Black-owned small businesses in the Bayview recently indicated that they actually didn’t apply for EIDL loans to keep going during this difficult economic period. When asked why not, their response was, “Why bother?”

Very few even knew where to go for assistance to apply for financial support from the feds – or for that matter from state or local agencies supposedly charged with serving their specific communities. No outreach efforts to show minorities how to seek or receive financial assistance for businesses like those on Third Street are evident in their community either. If it is not yet clear to anyone from the SBA reading this article, our message is simple: “Help!”

Mayor London Breed’s COVID-19 Economic Recovery Task Force – Office of Economic and Workforce Development – offers small loans, grants and fee deferments that could help reboot the economy for all of its constituents, including small businesses in the Bayview.

“We’re on our own,” says Bridget Carter, owner of California First Management, who has been self-funding her affordable housing management business for years and serving many in need throughout San Francisco County. Ironically, her property management business was also not eligible to apply for a PPP loan to cover payroll even though a lot of her tenants cannot afford to pay their rent at this time. Still, like so many strong Black woman entrepreneurs who’ve had to face hard times before, Ms. Carter never gives up.

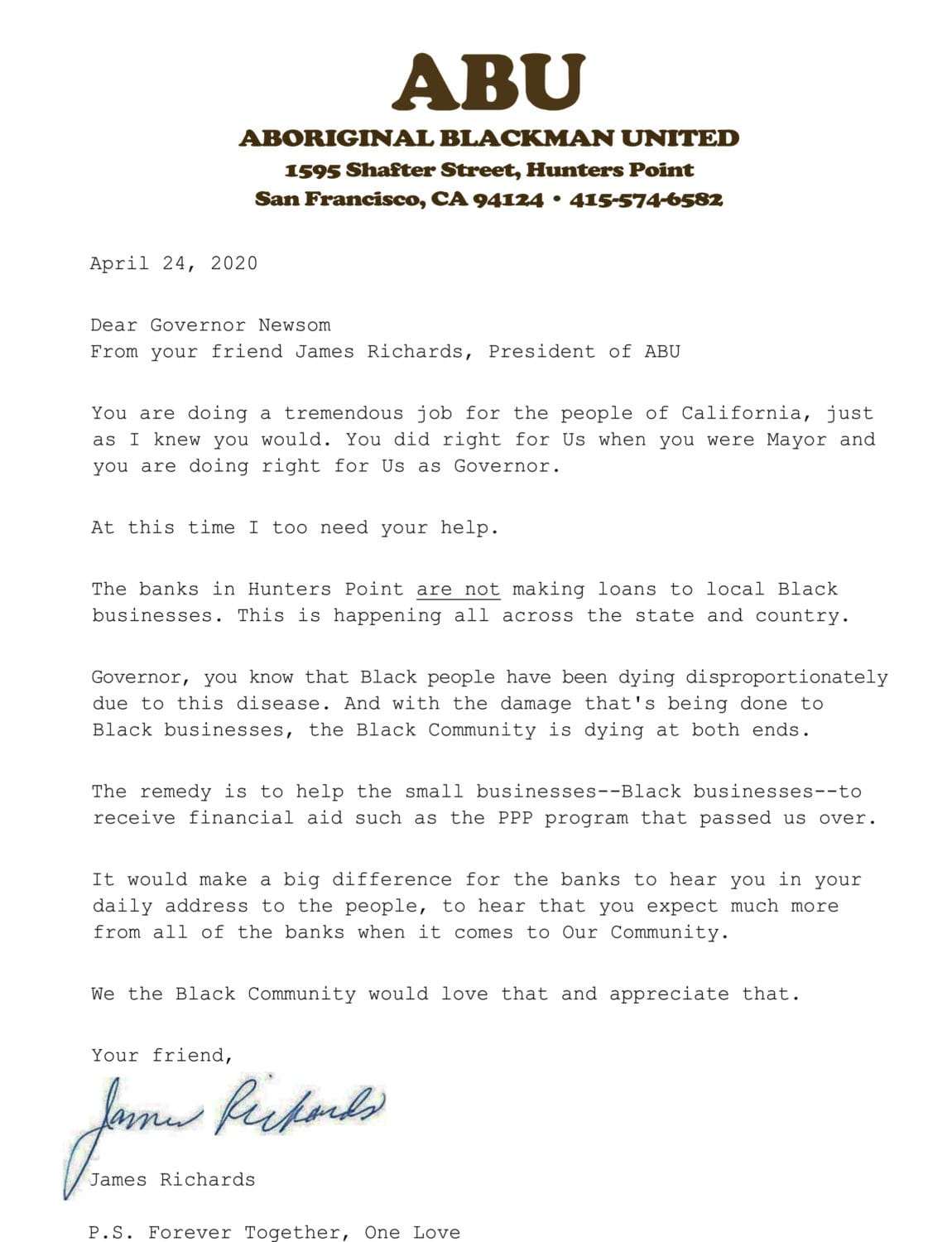

Community advocate James Richards from ABU also sent a letter to Gov. Gavin Newsom last month. His hope was that Newsom would call on banking and other institutions to do more for Black-owned businesses. Did his request fall on deaf ears again? So far, no word from the Newsom administration in response to Richards’ letter.

What are federal, state and local agencies doing to help us resurrect today? Richards points to the only source for support that he is aware of in San Francisco – Mayor London Breed’s COVID-19 Economic Recovery Task Force led by Joaquín Torres, director of the Office of Economic and Workforce Development. The City offers small loans, grants and fee deferments that could help reboot the economy for all of its constituents, including small businesses in the Bayview.

While Richards is grateful for these types of initiatives in San Francisco, he acknowledges that those opportunities are for minimal amounts. He believes that the SBA in particular should reach out to, and be present in, his community to help small and minority-owned businesses attain the financial aid they need. Teach us how to fish, and show us how we could benefit from programs intended to help targeted economies recover more efficiently.

“We are dying on both sides.” Richards points out that while African Americans seem to be the most impacted by the coronavirus, not enough is being done to provide financial support for us to be able to also survive the current economic crisis. “The trickle down is just not reaching us.”

More information in follow-up to this article is forthcoming as we obtain additional feedback from Bayview businesses and other community stakeholders. To that end, we invite you to send us your perspective in response to the question, “why not” bother?

Lin Robertson began her career by launching the Aruba Foreign Investment Agency in her native Aruba, a Caribbean island nation off the coast of Venezuela. Coming to California in 1998, she worked with the San Jose Office of Equality Assurance and in 2005 founded The Labor Compliance Managers, where she is managing director. She is also senior producer for International Media TV. Lin can be reached at lin.tlcm@gmail.com. This story is part of a series on Reversing the Out-Migration of Blacks from San Francisco funded by Fred Jordan of the San Francisco African American Chamber of Commerce.